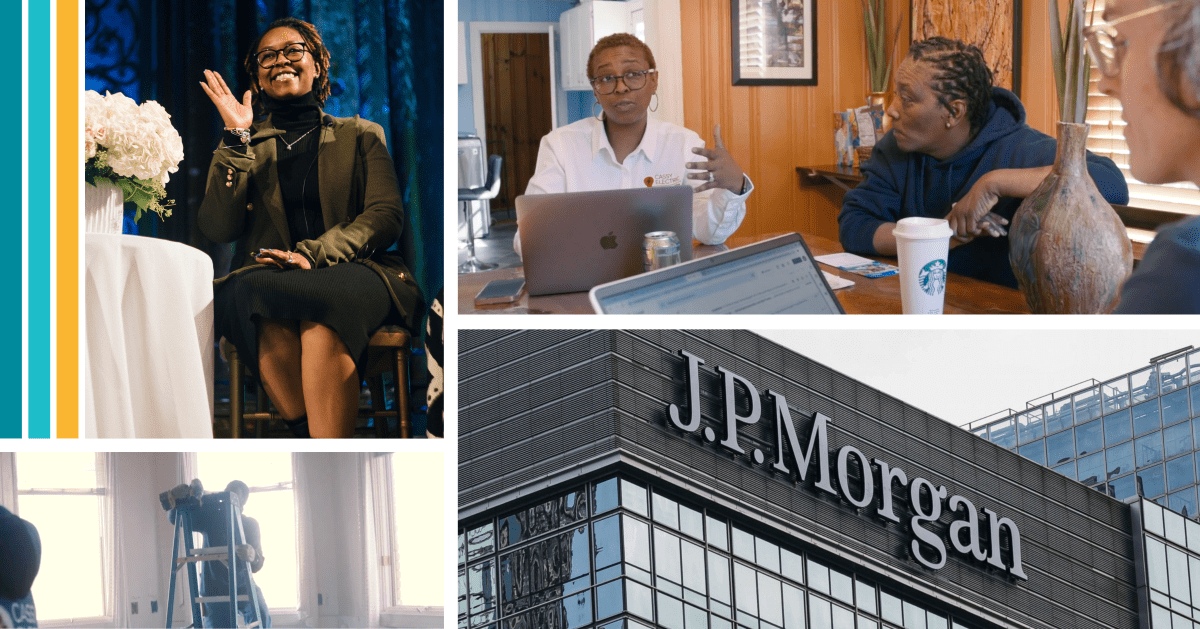

Ebony Sullivan isn’t your average entrepreneur. As the driving force behind Cassy Electric, Ebony’s journey is nothing short of inspiring. Her company stands among the mere 12% of Black-owned small businesses in the construction sector to break the $1 million revenue barrier. Inheriting the reins from her mother, Ebony’s vision was to propel the family business to new heights.

The Bpeace and Cassy Electric Story

When Bpeace met Ebony during the post-COVID recovery phase, Cassy Electric was generating a few hundred thousand dollars in revenue, despite 25 years in operation. Through the Bpeace Maximizer business accelerator, the company received personalized pro bono consulting in financial packaging and pitching. The outcome: Ebony secured the necessary funds, tripling the company’s revenue and surpassing the $1 million milestone. “When I came to this business four years ago,” Ebony recalls, “it was really basic. Everything was tied to my mother; we couldn’t even have a payroll.”

Aligning with JPMorganChase Institute Insights

This triumph aligns with the insights from the JPMorganChase Institute report, “Scaling to $1 Million: How Small Businesses Fare by Owner Race and Gender.” The report underscores a critical reality: Black-, Hispanic- and female-owned firms are the least likely to hit $1 million in revenue within five years of inception. This highlights an urgent need to expand financing opportunities from banks and financial institutions to equip small-business owners with the capital required for growth.

The Impact of Strategic Support and Mentorship

Ebony’s story epitomizes the transformative potential of strategic support and mentorship for women and intergenerational family businesses. “One of the most valuable insights we gained from Bpeace was learning how to make our money work for us,” Ebony explains. “Instead of merely spinning our wheels, we learned to use our capital strategically to establish a long-standing company where people want to work.” Ebony’s mother, Cassandra, a pioneer in the industry, founded the business when access to capital and information was even more restricted.

Overcoming Ongoing Challenges

Although progress has been made, barriers persist, as reflected in the latest JPMorganChase Institute report (April 2024). “We have done a great job utilizing our resources to grow, but our primary challenge remains securing the funding necessary to support and scale our operations effectively.” Ebony notes. “Without adequate funding, we cannot move into a larger space, which limits our ability to purchase materials in bulk, hire new employees and bid on larger projects.”

Key Factors for Success

The JPMorganChase Institute’s research also points to other vital factors that can make a difference, such as access to market information, supplier networks, contracting opportunities and owner business development and management skills. Enhancing accessibility and understanding of financial products, and strengthening relationships with banks and financial institutions are pivotal to transforming the financial landscape for diverse small businesses.

Bpeace’s Role in Addressing Disparities

Bpeace launched its U.S. programs in 2021 to tackle these disparities head-on, helping minority- and women-owned businesses thrive. We urge the JPMorganChase Institute to delve deeper into examining the intergenerational shifts in these businesses. Understanding how growth can occur at different stages of the business journey will be key to unlocking solutions targeted to support their evolution. Together, we can demonstrate that with the right support, diverse small businesses can overcome economic barriers and flourish.